University of California, Los Angeles - BS in Applied Mathematics, BA in Economics, 1991

Series 50 Municipal Advisor Rep (2016 to Present)

Series 54 Municipal Advisor Principal (2019 to Present)

Series 65 Investment Advisor Rep (2000 to Feb. 2020)

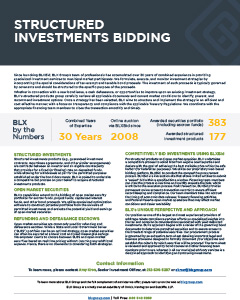

Eric Chu is a Managing Director and serves as the business group leader for BLX’s Structured Products services, which includes investment bidding as well as derivative advisory and monitoring services. He has particular expertise in interest rate derivatives, the investment of tax-exempt bond proceeds, and arbitrage rebate compliance. His expertise in financial products and in structuring arbitrage compliant solutions for complex transactions has helped BLX earn a reputation for technical excellence.

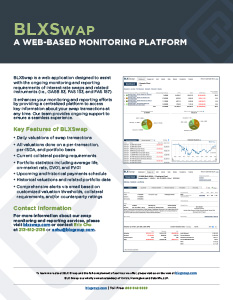

Eric has worked on hundreds of interest rate swap transactions in an advisory or on-going monitoring capacity. As an advisor, he has extensive experience in new transaction structuring, existing transaction workouts, ISDA document negotiation, and independent pricing of swap transactions to provide better transparency and execution for his clients. He assists numerous clients with swap monitoring and compliance with GASB 53 and 72 rules and corresponding FASB rules. He led the development of BLX’s swap monitoring platform, BLX SWAP, which allows clients to access their swap portfolios to monitor key data, as well as BLX’s GIC bidding platform, BLXBid, which allows clients to conduct real time sealed bid auctions for investment-related products.

Eric has been a featured speaker at several industry conferences, including the Bond Buyer’s Annual Conference and in educational seminars hosted by CDIAC. He was also the lead author for BLX’s booklet, Interest Rates Swaps: Application to Tax-Exempt Financing, which was featured in its entirety in The Handbook of Municipal Finance by Sylvan G. Feldstein, and Frank J. Fabozzi.