BLX Alert: TAX-EXEMPT ESCROW FUNDS: OPEN MARKET SECURITIES vs. SLGS

September 24, 2024

Is taking bids for OMS worth it?

Issuers and conduit borrowers refunding or defeasing outstanding tax-exempt debt generally have two funding options:

- Bidding out a portfolio of open market securities (“OMS”) consisting of US Treasury Bills, Notes and Bonds.

- Subscribing for a portfolio of time deposit State and Local Government Series securities (“SLGS”).

Municipal market participants can choose the lowest cost option by taking bids for OMS and comparing the best OMS bid to the SLGS portfolio cost. If SLGS are the lowest cost option, the issuer / borrower simply declines to accept the OMS bid and moves forward with the SLGS subscription. Conversely, if OMS are the lowest cost alternative, the best bid is accepted and no SLGS subscription is filed.

What is the benefit of taking bids for OMS?

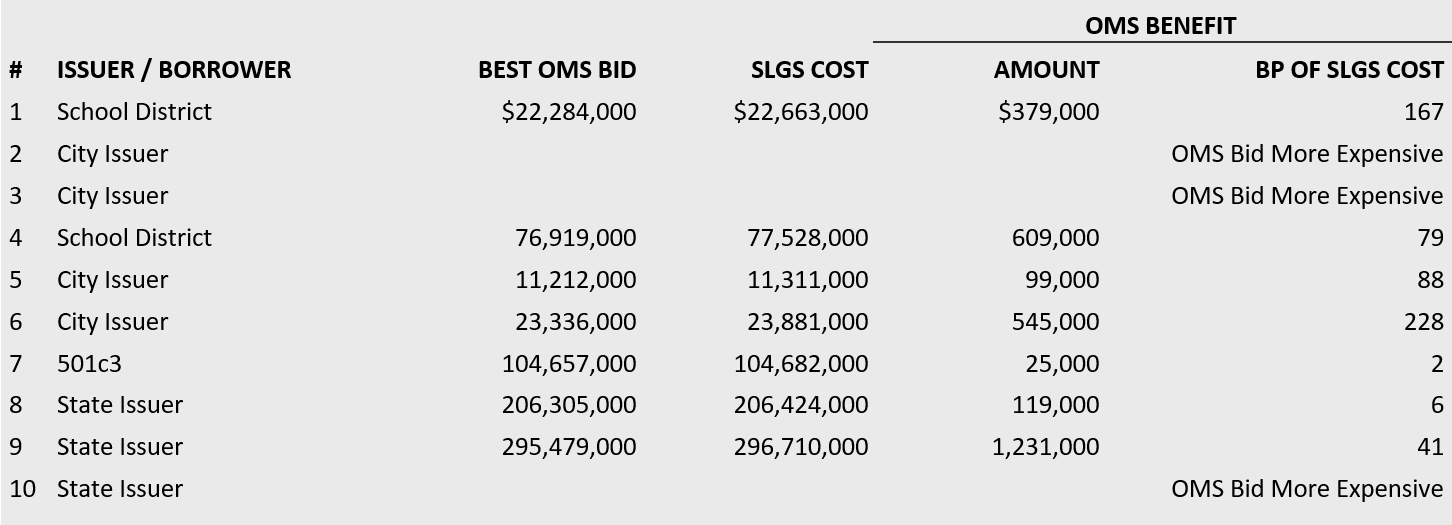

Below we review the last 10 OMS bids where BLX acted as bidding agent on behalf of the issuer / borrower1. In 7 of 10 cases, OMS were less expensive than SLGS.

1 Figures were rounded to the nearest 1,000 for illustration purposes.

What should issuers / borrowers consider in pricing and procuring OMS and SLGS?

For OMS bids, the issuer / borrower will hire a bidding agent. The above OMS benefit numbers have been reduced by the bidding agent fee. If the bid is not awarded, no fee is paid to BLX as the bidding agent.

SLGS may only be purchased if the proceeds are subject to the arbitrage rebate or yield restriction requirements under federal tax law. If SLGS can produce a yield equal to the bond yield, there is generally no reason to consider OMS.

At the opening of each trading day, the US Treasury publishes a rate table where maximum available SLGS coupon rates are set to “one basis point below the current estimated Treasury borrowing rate for a security of comparable maturity.” This implies that the yield on OMS should be .01% higher than SLGS, but the actual dollar cost difference will depend on several variables, including:

- The size and term of the escrow requirements; larger debt service requirements outstanding for longer periods of time will result in a larger cost differential.

- The extent to which Treasury rates fluctuate between the release time of the daily rate table and the specific time of the OMS bid (i.e., this will either increase or decrease the one basis point difference set by the rate table).

- How efficiently the cashflows generated from a portfolio of OMS meet the debt service requirements as compared to the efficiency of SLGS. Here, less uninvested cash is more efficient.

Whether bond documents permit securities other than Treasuries for defeasance purposes. A wider range of permitted investments can lead to lower costs for OMS over SLGS.

For more information on how the Notice could affect your organization or for other questions on post-issuance tax compliance, please contact us.