The BLX Institute

What it is

Post-Issuance / Private Use Compliance

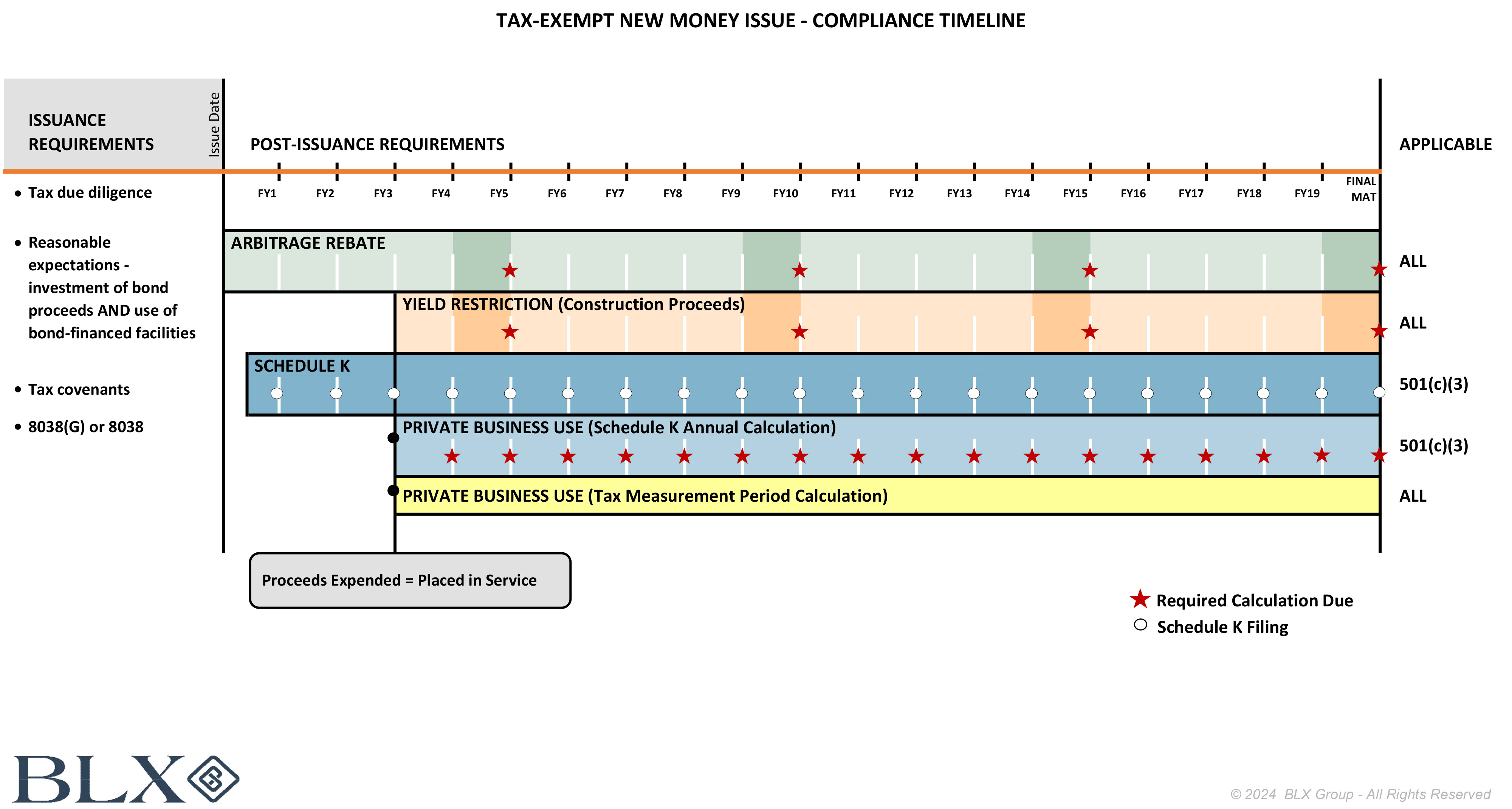

Compliance Timeline – Tax-Exempt New Money Issue

Tax-exempt bonds have numerous filing requirements and deadlines issuers and borrowers must comply with over the life of the bonds. The below timeline highlights compliance milestones related to arbitrage rebate compliance, private business use, and Schedule K filings (for nonprofit organizations).

BLX onCompliance

A monthly video series from BLX on compliance topics relevant to public finance and tax-exempt bonds.

BLX Alerts

A historical index of timely alerts based on relevant current events in public finance.

BLX is committed to continuing education and hosts webinars, on-site training, and workshops. For more information, please contact Cynthia Sixtos at [email protected] or 213.612.2207.

Bond Issuance Preparedness - New Money and Refundings Done Right (Jenna Magan, Orrick) - NEW! - 01/08/2026

In this episode of BLXonCOMPLIANCE, we discuss best practices for preparing for tax-exempt bond issuances, covering both new money and refunding transactions. We highlight the importance of early planning, good recordkeeping, and proactive investment strategies to ensure flexibility, compliance, and, hopefully, successful outcomes for issuers and borrowers. Focusing on these details up front can make the entire financing process smoother and more effective. Listen today for more information.

(January 8, 2026)