What We Do

Tobacco Bond Administrative Agent Services

Sustainable Finance Consulting

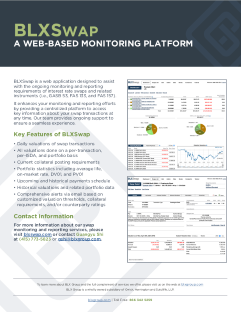

Swap Monitoring, Valuation, GASB 53/72

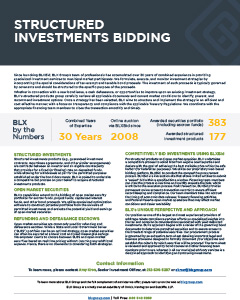

Structured Investment Product Bidding

Tobacco settlement asset-backed bond issuers face a complex post-issuance environment. In addition to the requirements of the IRS Treasury Regulations for tax-exempt bonds, issuers must also abide by the myriad of federal tax requirements specific to such transactions. Since the first tobacco transaction was issued in 2000, BLX has pioneered a comprehensive package of post-issuance consulting, compliance, and administrative services designed to establish critical procedures to significantly reduce the risk of non-compliance.

Such services include:

- Tobacco Settlement Revenue Allocation and Monitoring

- Universal Cap Analysis

- Hedge Bond and Endowment Fund Monitoring

- Arbitrage Rebate Compliance

- Continuing Disclosure

With regulatory changes occurring in the tobacco industry and ongoing litigation challenging the validity of the Master Settlement Agreement, the tobacco marketplace looks very different than it did in 2000. Fortunately, BLX offers an unparalleled combination of experience and expertise to monitor and address new developments as they occur.

For more information on BLX’s Tobacco Bond Administrative Agent Services, please contact:

Justin Gagnon, CFA

919 537 8855

[email protected]